By An Old Friend

Fri, Oct 22, 2021 11:52 p.m.

Oil System Collapsing so Fast It May Derail Renewables, Warn French Government Scientists

I've been aware of the Energy Return on Energy Invested [EROI] factor for a long time. That it declines is obvious, though maybe fracking gave things a new lease on life ... for awhile.

But that solar and indirect solar (i.e. wind and hydropower) and batteries are going to replace fossil fuels and retain our standard of living? That's a fantasy. For example, read this:

The material requirements for the batteries alone are a fantasy ...

[Deleted] will likely recommend nuclear. I wonder what the total nuclear resource is, counting uranium, thorium, breeder reactors, and whatever.

Then there's fusion, which is always fifty years in the future. (Not really a joke; I recall hearing in 1970 that it was about 50 years away ...)

But this is not because the earth is running out of oil and gas. Rather, it's because they are increasingly eating themselves to stay alive. The oil and gas industries are consuming exponentially more and more energy just to keep extracting oil and gas. That's why they've entered a downwards spiral of increasing costs of production, diminishing profits, rising debt and irreversible economic decline.Forget 'peak oil'. Nafeez Ahmed reveals how the oil and gas industries are cannibalising themselves as the costs of fossil fuel extraction mount

A team of French government energy scientists are warning that the collapse of the global oil system is coming so rapidly it could derail the transition to a renewable energy system if it doesn't happen fast enough. In just 13 years, global oil production could enter into a terminal and exponential decline, accompanied by the overall collapse of the global oil and gas industries over the next three decades.But this is not because the earth is running out of oil and gas. Rather, it's because they are increasingly eating themselves to stay alive. The oil and gas industries are consuming exponentially more and more energy just to keep extracting oil and gas. That's why they've entered a downwards spiral of increasing costs of production, diminishing profits, rising debt and irreversible economic decline.Hanging on for dear life to the old, dying fossil fuel paradigm is a recipe for civilisational suicide.The implication is that global energy shortages and price spikes will be a taste of things to come if we stay dependent on fossil fuels. Yet a growing narrative has instead wrongly pinpointed the 'clean energy transition' as the culprit.The Economist, for instance, describes the global gas price spikes as "the first big energy shock of the green era", blaming inadequate investment in renewables and "some transition fossil fuels" (like gas). This could lead to "a popular revolt against climate policies."This implies that the fundamental driver of global energy volatility is the transition away from fossil fuels: but this flawed narrative has it exactly backwards.Energy Return On Investment (EROI)

The key to understanding all this is in how the new study, published in Elsevier's Applied Energy journal, applies the concept of 'Energy Return On Investment' (EROI).Pioneered by systems ecologist Professor Charles Hall (whom I worked with on my book Failing States, Collapsing Systems) EROI measures how much energy you must use to extract energy for a given resource or technology. The metric works as a simple ratio that estimates the quantity of energy you can get out for every single unit of energy that's put in. So obviously, the higher the ratio the better, because it means you can get more bang for your buck.The new study is authored by three French government scientists – Louis Delannoy, Pierre-Yves Longaretti and Emmanuel Prados of the National Institute for Research in Digital Science and Technology (INRIA) which operates under France's Ministry of National Education and the Ministry of Economy, Finance and Industry – along with David J. Murphy, an environmental scientist and energy expert at St. Lawrence University in New York.Their research found that 15.5% – more than a tenth – of the energy produced from oil worldwide is already necessary to keep producing all the oil.Yet this is getting worse, not better. Since the production of the easiest-to-get conventional oil slowed down and plateaued around fifteen years ago, we're increasingly relying on forms of difficult-to-extract unconventional oil that uses greater amounts of energy for more complex techniques like fracking.The Downwards Spiral

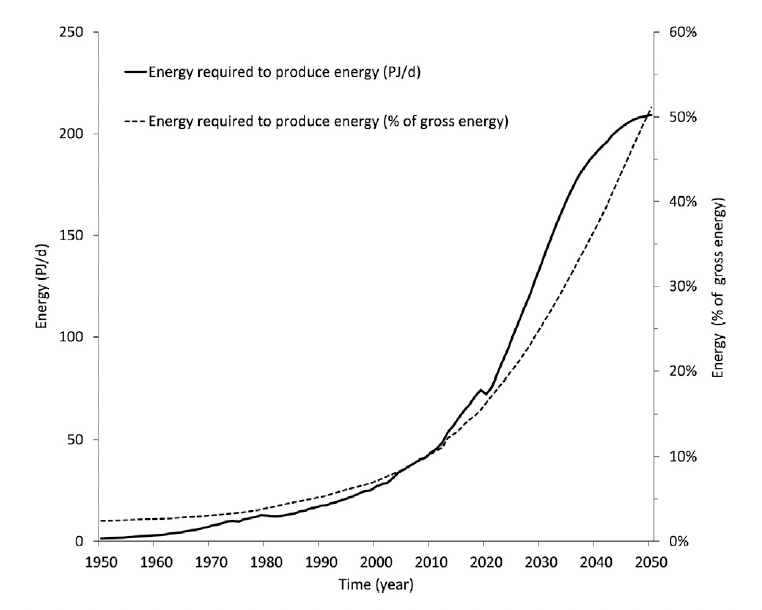

In 1950, the EROI of global oil production was really high, at about 44:1 (meaning, for every unit of energy we put in, we were getting a whopping 44 out). Yet as the graph below from the new study illustrates, this value has undergone a shockingly steep decline.By 2020, it reached around 8:1, and is projected to decline and plateau to around 6.7 from 2040 onwards. By 2024 – within the next four years – the amount of energy we are using for global oil production is going to increase to 25% of energy production. In other words, the world will be using a quarter of the energy produced from oil just to keep producing that oil.But instead of getting more efficient, fossil fuel technologies are getting less efficient – which is why the quantity of energy we need to keep producing oil is exponentially increasing.By 2050, fully half of the energy extracted from global oil reserves will need to be put back into new extraction to keep producing oil. The authors have an interesting name for this self-defeating phenomenon: they call it, "energy cannibalism."

By 2024 – within the next four years – the amount of energy we are using for global oil production is going to increase to 25% of energy production. In other words, the world will be using a quarter of the energy produced from oil just to keep producing that oil.But instead of getting more efficient, fossil fuel technologies are getting less efficient – which is why the quantity of energy we need to keep producing oil is exponentially increasing.By 2050, fully half of the energy extracted from global oil reserves will need to be put back into new extraction to keep producing oil. The authors have an interesting name for this self-defeating phenomenon: they call it, "energy cannibalism." This tendency is having massive consequences on long-term economic growth that few mainstream economists acknowledge today. The key issue is that the more energy we need to extract energy itself, the less energy is available for other areas of the economy and society.As economists Professor Tim Jackson and Dr Andrew Jackson of the University of Surrey have shown, there is now abundant scientific evidence that the decline in EROI is an underlying driver of the decline in economic growth.This suggests that the last two decades of global economic turbulence are closely related to the global economy's continued structural dependence on fossil fuels: a dependence that, if it goes on, will guarantee a grim future of energy and economic decline amidst mounting environmental crisis.

This tendency is having massive consequences on long-term economic growth that few mainstream economists acknowledge today. The key issue is that the more energy we need to extract energy itself, the less energy is available for other areas of the economy and society.As economists Professor Tim Jackson and Dr Andrew Jackson of the University of Surrey have shown, there is now abundant scientific evidence that the decline in EROI is an underlying driver of the decline in economic growth.This suggests that the last two decades of global economic turbulence are closely related to the global economy's continued structural dependence on fossil fuels: a dependence that, if it goes on, will guarantee a grim future of energy and economic decline amidst mounting environmental crisis.Yes, the Age of Fossil Fuels is Ending

What does this mean for the idea of 'peak oil'?Previous discussions about peak oil, the scientists say, were too polarised to be helpful. So they call for a re-opening of the debate based on these new findings, not because we are running out of oil (the authors point out that "we clearly have too much fossil fuels stock to respect ambitious climate targets"), but because our economic ability to access the oil affordably is declining at an exponential rate that decision-makers aren't talking about."If the shale tight oil has been able to compensate for the production plateau of conventional oils since the mid-2000s," they portend, "no other liquid is expected to take off and become the next backstop energy source."This, they argue, will define the point at which all global oil production will probably peak and decline – a date they suggest lies somewhere around 2034: that is, just 13 years from now."A contracting window exists between oil prices high enough so that extraction and development are viable and low enough to let consumers have access to it," they conclude. "From this perspective, peak oil will never be either totally peak supply or peak demand, but a mix of both in proportions that are difficult to measure and project."Other analysts have pointed out that technology disruptions like solar photovoltaics, wind turbines, batteries for storage and electric vehicles (EVs) are on track to eliminate demand for oil and gas over the next decade. Oil, therefore, faces a perfect storm from both above and below.In a separate new study, the same team looked at global gas data, finding similarly that while we're currently using 6.7% of global energy to produce gas, that quantity is growing at an exponential rate and will reach nearly a quarter by 2050.Over the next decades, then, oil and gas investments will become 'stranded' due to three converging pressures: climate policies demanding that fossil fuels stay in the ground; plummeting demand as fossil fuels and combustion engines are increasingly disrupted by solar, wind, batteries and EVs; and accelerating "energy cannibalism" as the oil and gas industries, ironically, consume themselves into oblivion in the process of trying to keep going.Aborting the Alternative

Perhaps the most alarming implication of the new research concerns renewable energy technologies. The authors conclude:"… either the global energy transition takes place quickly enough, or we risk a worsening of climate change, a historical and long-term recession due to energy deficits (at least for some regions of the globe), or a combination of several of these problems."So if we delay the clean energy transformation for too long, there might not be enough energy to sustain the transition in the first place – leading to a 'worst of all worlds' scenario: the collapse of both the fossil fuel system and the ability to create a viable alternative.The good news is that according to more and more research, the alternative could open up a vast new possibility space for human civilisation. According to financial think-tank Carbon Tracker, renewable energy technologies such as solar, wind and batteries are becoming more efficient, rolled out with increasing speed, and generating greater returns.As I've argued for the technology forecasting group RethinkX, there's also mounting evidence that renewable energy technologies have a higher and increasing EROI compared to fossil fuels, and if optimally deployed can avoid bottlenecks in minerals and materials supplies.There's no time to lose. The new research led by the French team confirms that whether we like it or not, human civilisation is in the midst of the most rapid transformation of the global energy system we've ever experienced. And hanging on for dear life to the old, dying fossil fuel paradigm is a recipe for civilisational suicide.

I haven't followed the energy sector for a while, but am very skeptical of claims that 'YES, THE AGE OF FOSSIL FUELS IS ENDING', since they've been appearing regularly for decades, and are now inextricably linked to a political agenda that generally involves widening government regulation and taxation (e.g. on carbon/emissions) -- I think the world still has plenty of oil (and coal) reserves.

ReplyDeleteThe US rose to the status of the world's largest oil producer several years ago due to fracking -- it is known that fracking typically produces a different grade of crude, and that yields from fracking wells decline more steeply than the yields of a drilled well.

Also the dramatic fall of oil prices in 2018/2019 resulted in a LOT of financial pain for heavily leveraged frackers, who generally sold a LOT of debt to finance the purchases of land or fracking rights when oil prices were significantly higher, in some cases more than 2x as high.

MYOCARDITIS ANYONE?SWEDEN SUSPENDS MODERNA SHOT

ReplyDeletehttps://www.zerohedge.com/political/sweden-suspends-moderna-shot-indefinitely-after-vaxxed-patients-develop-crippling-heart

GRA:For anyone under 31.But tell me,is there any reason to believe it doesn't affect anyone OVER 31 too--in an adverse way?

--GRA

No need to get panties in a bunch: the Energy Information Administration estimates that known supplies of coal would last 470 years. And yes, motor vehicle fuel can be produced from coal.

ReplyDeleteSecond, the NIH is a co-owner of the patent on the Moderna shot. Wonder why they and Fauci cannot be trusted?

"the difficulties involved in obtaining sufficient primary minerals to build as many batteries as the green dreamers want."

ReplyDeleteLithium for the batteries the greatest deposits in Afghan and now at the mercy of the Chinese. Good going Joe.

" continent-wide wind lulls (as Europe recently experienced) or total continental cloud cover."

ReplyDeleteBomb runs over Germany during WW2 often stymied by total cloud cover. Germans using dirty brown lignite coal in their coal-fired power plants to make up for lack of power from solar and wind. Good going Germany.