Tue, Apr 28, 2020 7:42 p.m.

https://www.zerohedge.com/markets/why-illinois-broke-109881-public-employees-100000-paychecks-cost-taxpayers-14b

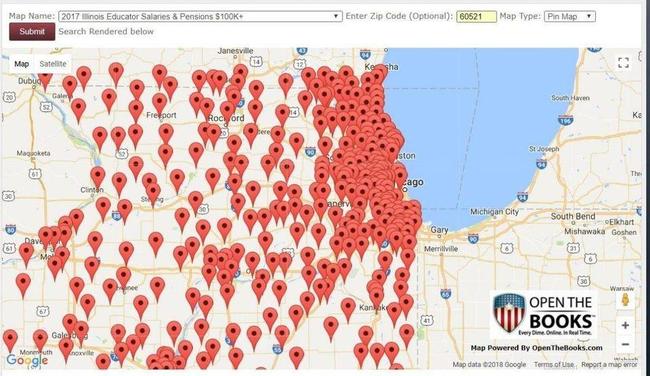

"Why Illinois is Broke: 109,881 Public Employees with $100,000+ Paychecks Cost Taxpayers $14B" | Zero Hedge

Submitted by Adam Andrzejewski, originally published in Forbes,.[sic] Illinois could soon be the first state in history to have its bonds rated as "junk." Last month, both Moody's MCO and Standard & Poor's downgraded Illinois debt to just one notch above junk status. Last week, the Illinois State Senate President Don Harmon (D-Chicago) wrote a letter to Congress requesting a $41.6 billion ...

www.zerohedge.com

R.C.: Trump is correct.

Let 'em go bankrupt.

Not only the normal paycheck. Retirement too. Teachers for the last three years of teaching don't take any sick days or personal days. They get paid their last paycheck for all those accumulated days and doubles the monthly pension payout for life. A good deal for all of them. No wonder these pension funds are broke.

ReplyDeleteContrary to ZeroHedge, which is wrong most of the time, the State of Illinois has about 65,000 employees and only a small fraction of those, maybe 8-10%, make over $100,000 dollars a year. Regular teachers are not State of Illinois employees, but those of local government. The only ones who are not are those college teachers at State colleges and universities.

ReplyDeleteThe State of Illinois is not broke--it actually turns a surplus every year. I have checked the audits. Who knows who is stealing from the State coffers, but it isn't government employees. A huge chunk of the Illinois' debts are from State bonds being sold, the revenues of which are then lent out to private entities at favorable rates. Since the ledger books of the State only record the bond sales as debts, but don't record the private debtors loans as assets (like any bank would) the State looks like it's drowning in debt, when a lot of that debt is actually owed back to the State via those private entities.

This is the actual situation in all the States. They all have medical, educational, and economic development "finance authorities" that sell State bonds to raise revenue for private entities. It makes it look like all the States are in much worse financial shape than they really are.

The pension "mess" is all bogus too. It's just another way to screw regular people out of jobs with good benefits and pensions.

"The State of Illinois is not broke--it actually turns a surplus every year."

ReplyDeleteNo state in the Union turns an annual "surplus." Talk about a credibility-buster!